Why most wellbeing allowances fail to make impact.Why most wellbeing allowances fail to make impact.

Employee wellbeing has rapidly become one of the most critical considerations for businesses seeking sustained productivity, engagement, and retention. Wellbeing allowances have emerged as an increasingly popular method for organisations aiming to proactively support employee health, but their effectiveness can vary significantly based on how they are structured and managed. This article explores the different approaches to wellbeing allowances, evaluates their effectiveness, and introduces innovative strategies to enhance their impact.

What are wellbeing allowances?

Wellbeing allowances are funds provided by employers to support their employees’ health and wellness. These allowances can be used for a variety of wellbeing-related expenses, such as gym memberships, therapy sessions, nutritional supplements, and more. The goal is to enhance employees’ physical, mental, financial, and emotional wellbeing by giving them the resources to invest in their health.

Traditional wellbeing approaches, such as Employee Assistance Programs (EAP) and health insurance, often act as a safety net or a reactive measure, addressing issues only after they have become significant problems. While these programs are important, they are often seen as “bottom of the cliff” solutions.

Other initiatives, like offering gym memberships or wellbeing apps, are well-intentioned but often suffer from low engagement due to their one-size-fits-all approach. Employees may not find these options relevant or useful to their specific needs, leading to underutilisation.

Wellbeing allowances represent a step in the right direction by empowering employees to take control of their health and wellness in a way that suits them best. Instead of prescribing a specific solution, employers provide the means for employees to choose the wellbeing benefits that matter most to them. This personalised approach can lead to higher engagement, better health outcomes, and a more satisfied workforce.

Traditionally businesses have gone about providing allowances in one of three ways:

- Cash-based allowances

- Debit Card-based allowances

- Reimbursement and receipt-based allowances

Cash based wellbeing allowances

Cash-based allowances involve giving employees direct cash payments to spend on their wellbeing. These payments can be made as a lump sum bonus or alongside regular payroll. This approach is one of the easier ways to provide wellbeing allowances because it requires very low administrative effort and no third-party costs.

However, the main problem with cash-based allowances is that because it’s cash, people very rarely spend it on wellbeing. In fact, when we interviewed businesses offering cash allowances, we found that the majority of staff spent their allowances on things like clothing, alcohol, and other retail purchases. Effectively, cash-based wellbeing allowances aren’t wellbeing allowances at all; they are just employee perks disguised as a wellbeing initiative.

This means that while staff may appreciate the perk of receiving the allowance, organisations are likely to see no return on investment in terms of team productivity, engagement, or overall wellbeing.

Reimbursement & Receipt-Based Allowances

Reimbursement or receipt-based allowances involve a variety of approaches, all of which can be cumbersome and confusing. In some cases, staff members spend their own money on wellbeing services or products and then request reimbursement from their employer by providing receipts. Other times, employees must request approval from their employer before making a purchase. If approved, the employer either gives them the money or pays the supplier directly.

While employers have more control over how allowances can be spent using this approach, there are a number of major drawbacks, including:

- Lack of Privacy: When staff submit receipts, they are revealing what wellbeing support they have accessed. For this reason, many staff avoid accessing meaningful support like therapy, or medical expenses, for fear of judgement. Instead they opt for more generic purchases like new shoes. Not only does the lack of confidentiality reduced impact, but it also exposes the employer under Privacy Act. Recently, leading law firm, Buddle Findlay, warned of the potential Privacy Act breaches resulting from receipt based allowances.

- Financial Barrier for Employees: When staff are required to pay out of pocket and be reimbursed, many cannot afford this. There is also a risk of spending on something that isn’t approved and not getting reimbursed.

- Approval Process: Employees must request and wait for approval, which can sometimes be slow and frustrating. Decisions on what is allowed can be subjective and arbitrary, causing frustration if purchases aren’t approved.

- Policy Challenges: Employers need a clear policy on what is allowed. Is therapy covered? What about music lessons? Food delivery, childcare or an Apple Watch? Employers, who may lack expertise in wellbeing, must constantly decide what is allowed, leading to arbitrary and frustrating outcomes for both parties.

- Administrative Burden: Keeping track of who has used their allowances, how much they have claimed, and managing new hires or departures is complex. Additionally, tracking receipts, paying suppliers, and reimbursing staff requires extensive administrative work, potentially necessitating a dedicated team to manage the allowances.

Card-based wellbeing allowances

Card-based allowances involve the company purchasing prepaid credit or debit cards from a third-party provider. Employers must pay for the cards themselves, as well as ongoing platform fees, on top of the allowances, making this an expensive way to provide wellbeing benefits.

Depending on the third-party provider, these cards can either be spent anywhere, which makes them very similar to cash allowances and suffering from the same lack of wellbeing impact, or they can be restricted to purchases at locations with specific retailer POS terminals set to certain merchant codes.

While card-based allowances may sound good in practice, there are several major flaws, including:

- Lack of Curation: For example, if a sporting goods shop accepts the card, there is nothing stopping someone from purchasing high-sugar energy drinks, sunglasses, or socks intended as gifts. The lack of curation means spending is not necessarily on wellbeing products.

- Lacks Confidentiality and Exposes Private Health Data: Employers can see the names and locations of retailers where staff have spent their allowances, making it an unsafe and non-confidential way for staff to engage with wellbeing services. This could unintentionally disclose sensitive and private health and medical information to others in the team who oversee the cards. For more about how these allowances potentially breach the Privacy Act, you can check out this resource and legal opinion from leading law firm Buddle Findlay warning about paying allowances this way.

- Limited Acceptance by Small Businesses: Many valuable wellbeing providers, such as therapists and bodywork specialists, often don’t accept card payments, making significant wellbeing offerings unavailable through this method.

- Unpredictable Acceptance: Employees may not know in advance where their cards will be accepted. They might be embarrassed if their card is declined at a counter where they expected to make a purchase. Conversely, they might miss out on spending at places that do accept the card but they were unaware of.

- Potential for Misuse: Finally, there is no mechanism to prevent employees from giving their cards to someone else to use, which completely undermines the original intent of the allowance as it won’t even be spent on the employee at all.

A new approach is needed

Clearly, traditional wellbeing allowances aren’t having the desired result or impact on either teams or employers. To make wellbeing allowances truly beneficial, we need a way to curate suppliers so that staff can only spend their allowances on genuine wellbeing offerings. Additionally, the system needs to be confidential, ensuring that staff feel safe to spend on high-impact services like therapy, specialists, and financial coaches without fear of their spending being disclosed to their employer.

Furthermore, the solution must be cost-effective and not require excessive spending on third-party card providers or consultants to design and oversee allowance policies. Finally, the process needs to be automated and low admin to make it appealing, effective, and efficient for employers.

Introducing Givenwell.

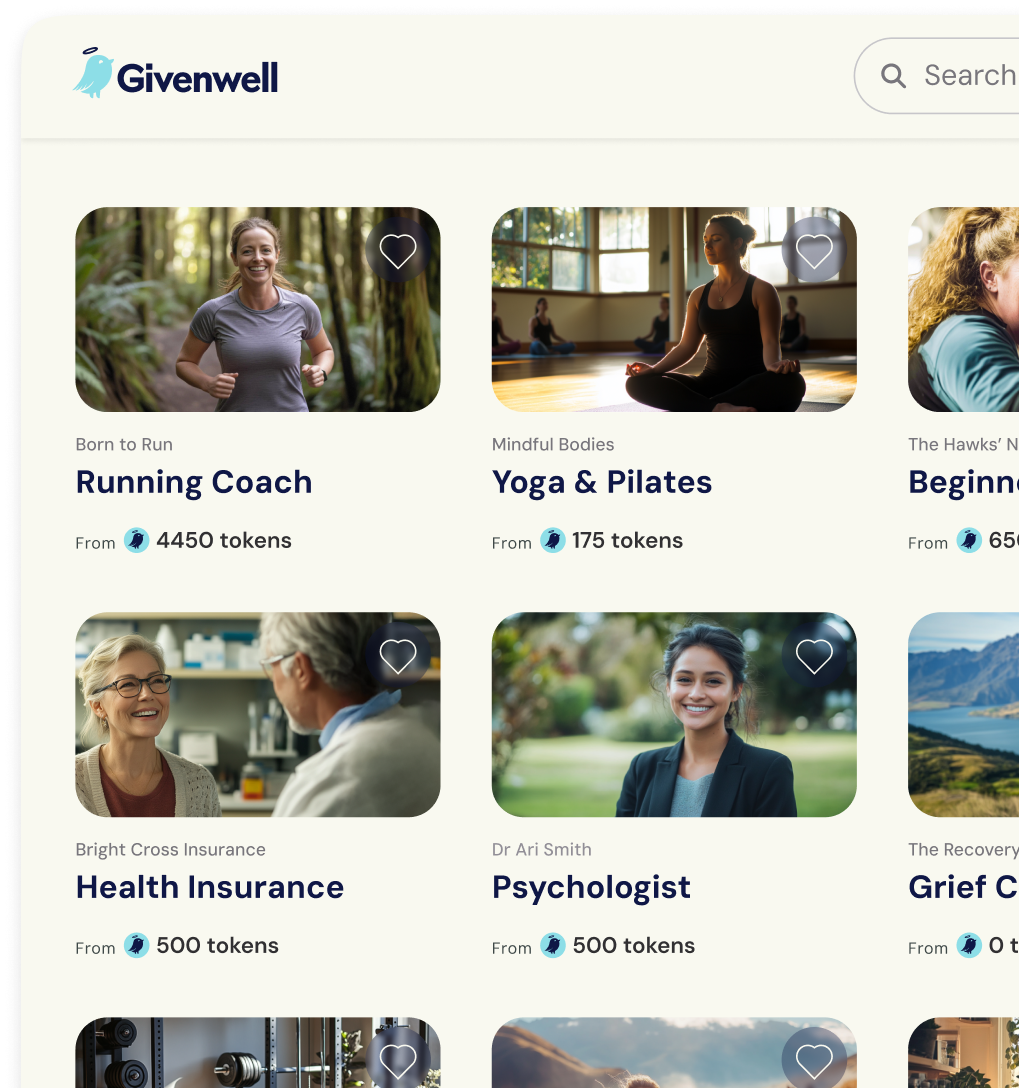

Givenwell is designed to enable employers to provide their teams with wellbeing allowances in a way that is confidential, automated, and ensures allowances can only be spent on meaningful wellbeing offerings.

Learn more

Givenwell is a new and better way to offer team wellbeing allowances:

- Spending Limited to Wellbeing Marketplace: Instead of cash or cards, staff receive digital tokens that can only be spent on a carefully hand-picked group of wellbeing products, services, and experiences listed on the Givenwell marketplace.

- 100% Confidential: Spending is confidential for staff, with employers not knowing when or how they are spending their allowances.

- Flexible and Automated: Employers can create recurring and one-off allowances for their team easily, online, and have everything totally automated by the Givenwell software.

- Track and Measure Performance: Employers can view generalised reports showing the utilisation of tokens and trends in what types of things the team is spending on, without disclosing individual spending behaviour. This provides valuable insights and helps measure the effectiveness of the program.

By choosing Givenwell, employers can ensure that their wellbeing allowances are truly focused on wellbeing and not just a perk. This means employers can expect a meaningful impact on their teams’ health and wellness. Importantly, businesses can also expect a return on investment from their allowances, with research suggesting a 1.5-6X ROI for measures like Givenwell. For more detailed information, check out our research into the ROI of wellbeing programs here.

| Givenwell | Receipts | Cash | Cards | |

|---|---|---|---|---|

| Spending is confidential | ||||

| Only spent on wellbeing | sometimes | |||

| Low admin & overhead | ||||

| Privacy Act compliant |

Stay in the loop

Sign up to hear about new features, platform updates, and everything in between.

By subscribing, you are consenting to Givenwell's privacy policy.